- What is a Budget?

- Why Budgeting Matters

- Choose A Method That Suits You

- Set SMART Financial Goals

- Build Your Budget Step by Step

- Visualize Your Progress

- Stay Accountable & Build Habits

- Troubleshooting Common Pitfalls

- Level Up: Advance Your Financial Strategy

- Recommended Tools & Resources

- Final Thoughts

- Want To Go Further?

What is a Budget?

A budget is simply a plan for your money. It’s a detailed outline of how much income you have coming in and how you’ll allocate it toward different expenses, savings, and financial goals over a set period, usually a month.

Think of it as your financial roadmap. It helps you:

- Understand where your money goes (rent, groceries, entertainment, etc.)

- Stay in control so you don’t overspend

- Prioritize what matters like saving for an emergency, paying off debt, or planning a holiday

- Reach long-term goals such as buying a home, retiring comfortably, or investing

In practice, a budget can be as simple as a handwritten list, a spreadsheet, or a budgeting app that tracks spending automatically.

Budgeting isn’t just about restricting your spending, it’s about empowering you to take control of your money and build the life you want. For beginners, the journey can feel overwhelming, but a simple, well-structured approach will change that. Let’s dive deep into everything you need to start budgeting confidently, set meaningful financial goals, and stay on track.

Why Budgeting Matters

Imagine driving without a destination, fun at first, but ultimately directionless. A budget serves as your financial roadmap. It helps you:

- Know exactly where your money is going.

- Allocate funds for essential expenses.

- Save for what matters, whether that’s an emergency fund, travel, or retirement.

Real-world impact: According to the Consumer Financial Protection Bureau, people with structured budgets report 60% greater financial confidence and are twice as likely to handle emergencies without debt.

Choose A Method That Suits You

There’s no one-size-fits-all. Pick a plan that aligns with your personality and goals:

| Method | Overview | Best For |

|---|---|---|

| Zero-based budgeting | Every dollar is planned income minus expenses equals zero. | Detailed planners |

| 50/30/20 rule | 50% needs, 30% wants, 20% savings/debt. | Beginners, simplicity lovers |

| Envelope system | Cash in envelopes for categories you stop when the envelope’s empty. | Spending discipline, cash users |

| Automatic software | Tools like Mint or YNAB track it all. | Busy folks, tech-savvy users |

Choose one and commit for a month—track every pound, dollar, or euro. Adjust monthly until it clicks.

Set SMART Financial Goals

Budgeting isn’t teaching you to be miserly; it’s about creating with purpose. Frame your goals SMART:

- Specific: “Save £3,600 for a holiday in one year.”

- Measurable: “That’s £300 per month saved.”

- Achievable: “I’ll reduce takeaways by £75 and bulk-buy groceries.”

- Relevant: “I love travel and want freedom.”

- Time-bound: “Goal achieved by July 2026.”

Quick tip: Break long‑term goals into short-term segments celebrate milestones to keep motivated!

Build Your Budget Step by Step

- Calculate net income: After‑tax pay, side gigs, passive income.

- List all expenses:

- Fixed: rent, subscriptions

- Variable: groceries, petrol

- Periodic: insurance, gifts

- Assign every pound: Follow your chosen method.

- Review & tweak monthly.

Here’s a budget template example using the 50/30/20 rule:

| Category | % of Income | Monthly Budget (£/€/$) |

|---|---|---|

| Needs | 50% | 1,500 |

| Wants | 30% | 900 |

| Savings & Debt | 20% | 600 |

| Total | 100% | 3,000 |

Once you know your income and spending categories, you can draft your first monthly budget. Here’s an example of what a £3,000 monthly budget might look like under the 50/30/20 model:

| Category | Budget (£/€/$) |

|---|---|

| Income (net) | 3,000 |

| Needs (≈50%) | 1,500 |

| Rent/mortgage | 900 |

| Utilities & internet | 150 |

| Groceries | 300 |

| Transport | 150 |

| Wants (≈30%) | 900 |

| Eating out | 200 |

| Entertainment | 150 |

| Shopping & hobbies | 300 |

| Miscellaneous | 250 |

| Savings/Debt (≈20%) | 600 |

| Emergency fund | 200 |

| Pension/investments | 200 |

| Debt repayment | 200 |

| Total | 3,000 |

You can use a simple spreadsheet, or even better, a free Google Sheets template. Google’s budgeting templates and Microsoft Create’s budgeting tools are easy to customize.

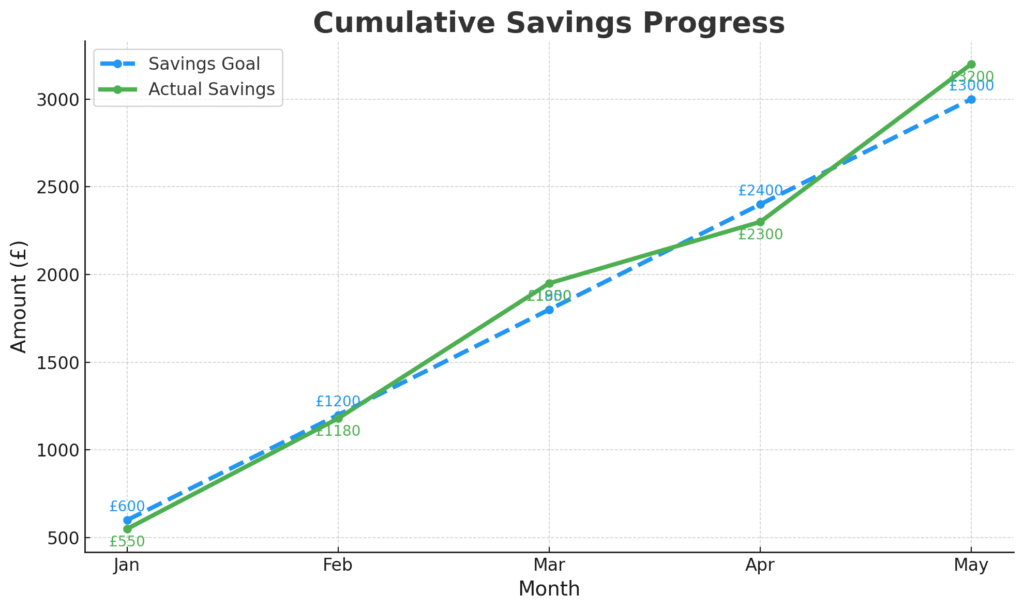

Visualize Your Progress

Tracking your budget is important but so is seeing how you’re doing. A chart tells the story better than numbers.

Sample Cumulative Savings Chart:

| Month | Savings Goal (£/€/$) | Actual Savings (£/€/$) | Difference (£/€/$) |

|---|---|---|---|

| Jan | 600 | 550 | -50 |

| Feb | 1,200 | 1,180 | -20 |

| Mar | 1,800 | 1,950 | +150 |

| Apr | 2,400 | 2,300 | -100 |

| May | 3,000 | 3,200 | +200 |

📈 In this example, by March the saver is ahead of the goal line, an intrinsic motivator to stay on track. Use tools like Excel, Google Sheets, or budgeting apps to generate such charts automatically.

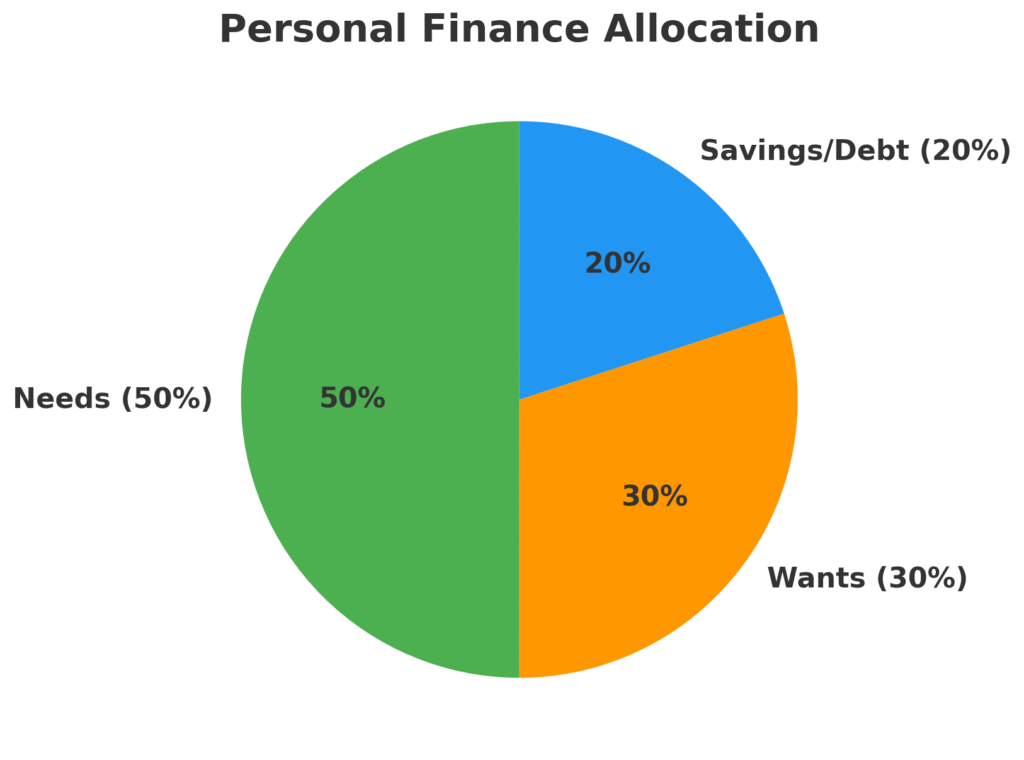

Numbers on a page can feel abstract, so it helps to visualise them. A simple pie chart dividing your expenses into needs, wants, and savings makes it easy to see whether you’re living within balance.

Sample Finance Allocation Chart:

Are your “wants” creeping toward 40%? Is your savings lagging behind? Visual tools highlight problem areas before they spiral. Many budgeting apps like YNAB or Mint automatically generate colourful charts to track your spending trends, helping you stay accountable without extra effort.

Stay Accountable & Build Habits

- Weekly check‑in: A quick review keeps you aware of your habits.

- Monthly reset: Reconcile accounts, adjust overspending, celebrate wins.

- Use tools & reminders: Leverage calendars and automatic transfers.

- Find community: Forums like r/personalfinance share tips, encouragement, and real‑life success.

Troubleshooting Common Pitfalls

- Underestimating expenses: Add a “miscellaneous” buffer 2–5%.

- Impulse buys: Institute a 24‑hour rule.

- Irregular income: Base budget on minimum income; direct surplus to savings.

- Losing momentum: Revisit why you started. Try gamifying your progress.

Level Up: Advance Your Financial Strategy

Once basics are in place, elevate your plan:

- Emergency fund: 3–6 months of expenses.

- Debt snowball/avalanche: Prioritize high‑interest debts.

- Invest: Start with low‑cost index funds (Vanguard, iShares).

- Retirement contributions: Maximize workplace schemes or individual plans (e.g., SIPP in the UK, IRA/401(k) in the U.S.).

Need guidance? The Fidelity Investing Retirement Planner is a strong planning tool.

Recommended Tools & Resources

- Budgeting software:

- Templates:

- Vertex42 – Excel/Sheets

- Communities:

- Educational resources:

Final Thoughts

Budgeting isn’t about deprivation—it’s about direction. A budget aligned with your values gives you freedom—not limits. Every pound tracked and goal set strengthens your financial foundation and morale. Start today, remain consistent, and watch your small changes compound into real progress.

Next step: Choose one budgeting method, download a template, and plan out your next month—by this time next month, you’ll already see the benefit.

Want To Go Further?

- Looking for debt paydown strategies?

- Need help investing with confidence?

- Want to master passive income streams?

Let me know, I’d be happy to help you on your journey!